US interest rates, inflation and the JSE

US interest rates, inflation and the JSE

22 April 2022

![us interest rates us interest rates]()

|

Investing at the moment is no longer a case of shooting fish in a barrel, but it is the moment for clear heads, plentiful research and astute strategies.

The ongoing Russian invasion of Ukraine is forcing energy prices upwards which, in turn, leads to a further increase in household bills.

Equities as an asset class are expected to beat inflation.

|

“The anticipated rate hikes can be treated as a continuation of the 2016 hike cycle to tackle a decade of quantitative easing.”

Casual reasoning evaluates whether an event has a cause-and-effect relationship to another event, or if they just happened to occur at the same time.

Right now, for instance, the economic news cycle is mulling over inflation, and global central banks are trying to deal with rising inflation by applying rate hikes, more of which are anticipated. This leads to the question of whether there is a true cause-and-effect relationship between inflation and the US Fed interest rate.

In theory, there should be an inverse relationship. Or are we dealing with something akin to the Latin fallacy ‘Post hoc ergo propter hoc’, which translates to: ‘after this, therefore because of this’.

BACKGROUND

We are now two years on from March 2020, the onset of the global Covid-19 pandemic and the associated market turmoil. Figures 1 and 2 show the two years following the global financial crisis (GFC) market crash and the Covid-19 outbreak respectively. The Nike swoosh shape of the Covid-19 crash in US markets and recovery is strikingly different from the L-shaped situation in 2008 when markets only recovered from the GFC by 2015. Conversely, one of the many reasons for the fast recovery from the recent crash could be the quicker and bigger response from central banks, particularly the US Fed.

Figure 1: Crash and recovery - Global financial crisis (2007-2009)

![figure-1---crash-and-recovery figure-1---crash-and-recovery]()

Source: Bloomberg, Ashburton Investments

Figure 2: Crash and recovery - Covid-19 (2019-2021)

![figure2---crash-and-recovery figure2---crash-and-recovery]()

Source: Bloomberg, Ashburton Investments

By 2015, once the market had recovered from the GFC, the Fed began to strategically raise interest rates with little market chaos. When the pandemic shock came in 2020, this crisis replaced the tightening plan with an accelerated easing plan. So, the anticipated rate hikes can be treated as a continuation of the 2016 hike cycle to tackle a decade of quantitative easing. The inflation problem the Fed was trying to address in 2016 has grown from year-on-year CPI of 2-3% to 7-8%.

“When the pandemic shock came in 2020, the crisis replaced the

quantitative tightening plan with an accelerated quantitative easing plan.”

UNPICKING THE RATE-INFLATION RELATIONSHIP

Having set the stage, let’s now try to evaluate the relationship between Fed rates and inflation by using a simple linear regression between the two variables to see whether one is the solution for the other.

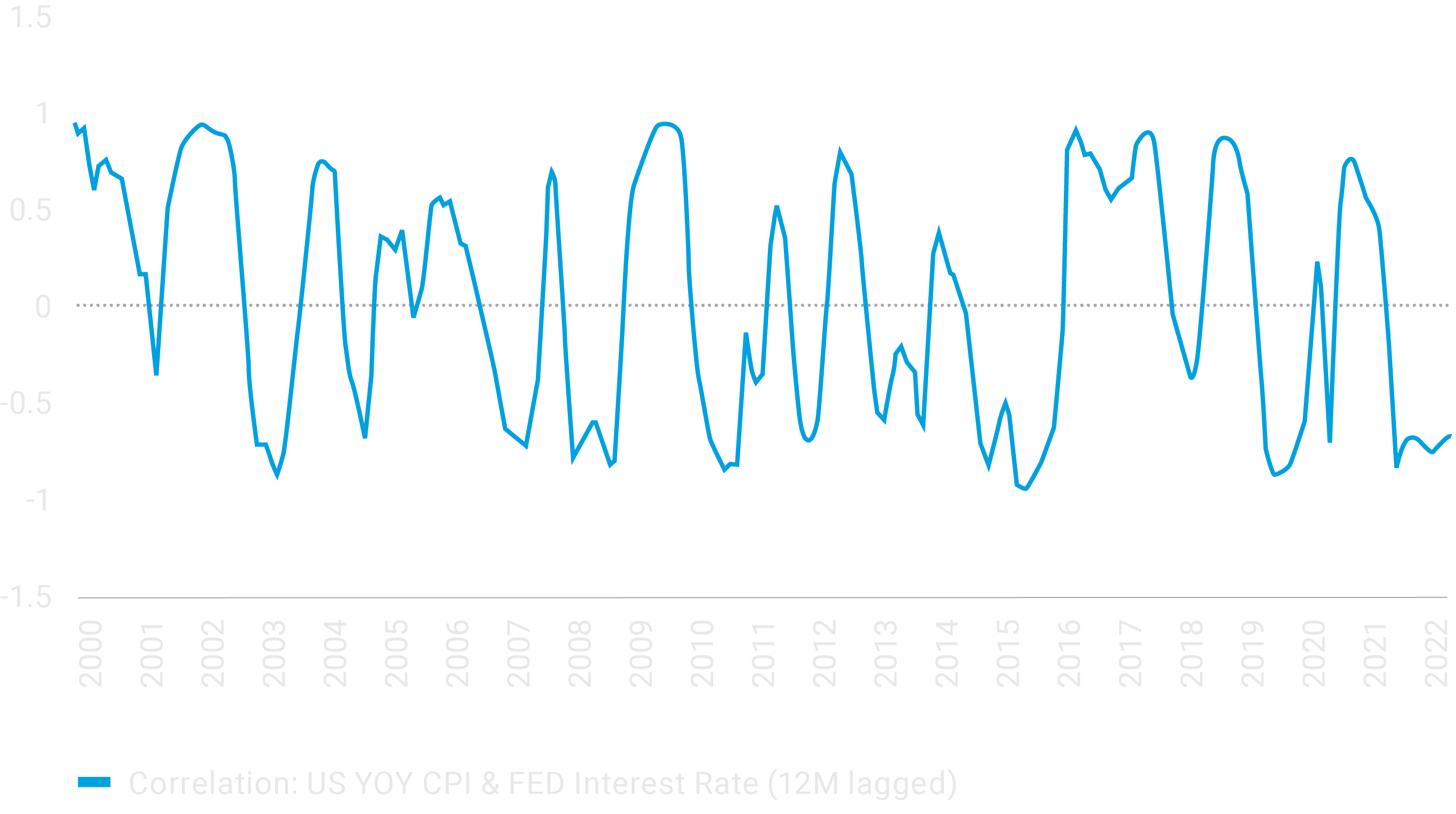

In Figure 3, a 22-year regression of US interest rates (12 month lagged) as the independent variable and US year-on-year CPI gives a low R square of 0.11. There is a strange low positive correlation of 0.34 instead of an expected negative number, which would represent an inverse relationship. The rolling correlation over time explains, in part, the lack of explanatory power of US interest rates on CPI. The relationship is behaving more like a cyclical phenomenon switching between strong positive and negative correlation (as illustrated in Figure 4).

Figure 3: Causality test - US inflation vs. Fed interest rates

![figure-3---causality-test figure-3---causality-test]()

Source: Bloomberg, Ashburton Investments

Figure 4: Correlation – US year-on-year CPI and Fed interest rate

Source: Bloomberg, Ashburton Investments

Currently we are seeing a strong negative correlation. In fact, for inflation to come down with rate hikes, it would need to stay negative instead of going cyclical. The mean reverting nature of asset prices explains inflation cycles in a more intuitive way, which takes us into the next point: the opportunity universe.

JSE OPPORTUNITY UNIVERSE

Although volatility indices, such as the CBOE VIX and JSE SAVI Index, measure implied volatility, the opportunity set measurement is more intuitive by calculating the magnitude of winners/losers from the broader market index, the cross-sectional volatility index.

Figure 5: JSE ALSI cross-sectional volatility

![figure-5---jse-alsi-cross-sectional-volatility figure-5---jse-alsi-cross-sectional-volatility]() Source: Bloomberg, Ashburton Investments

Source: Bloomberg, Ashburton Investments

Cross-sectional volatility measures the size of the opportunity set or the standard deviation of asset returns relative to the broader market index. A certain level of cross-sectional volatility is needed for active managers. After all, one can only pick winners relative to a broader index if winners exist. However, when the opportunity set is too wide, everyone is a winner.

We went through a similar period over the last two years. The higher probability of positive returns in a low inflation environment was the past regime. The cross-sectional volatility graph from March 2020 to quarter two of 2021 illustrates this (Figure 5). But the cross-sectional volatility graph has changed direction, indicating the opportunity universe is narrowing. In other words, there are fewer winners compared to the market, which makes stock picking difficult.

“The higher probability of positive returns in a low inflation environment was the past regime.”

IN A NUTSHELL

Currently South African inflation is at 5.7%, below the US inflation number of 7.5% in February 2022. The ongoing Russian invasion of Ukraine is, however, forcing energy prices upwards which, in turn, is likely to lead to a further increase in household bills.

Right now, the negative real return risk for the investor - as mentioned at the start of this article - needs a mitigation strategy. Equities as an asset class is expected to beat inflation. But since the equity opportunity set is not as wide as it used to be, equity exposure needs to be an actively selected and curated list of businesses that have stood the test of time and are priced right.

Investing at the moment is no longer a case of shooting fish in a barrel, but it is the moment for clear heads, plentiful research and astute strategies.

![Magazine magazine thumbnail_250x279]()

Click image to download a PDF copy.