In a volatile and uncertain world, where investment returns are unpredictable, wouldn’t you like the opportunity to access up to 25 of the world’s leading mega cap stocks? Wouldn’t it be even better if they came to you?

From R500 per month or a lump sum of R5 000 via the rand feeder fund, you can put your money to work with the world’s best.

The Ashburton Global Leaders Equity Fund is a concentrated portfolio of the world’s most prominent companies as measured by market cap, with the aim of delivering sustainable superior returns over the long term through geographic and sector diversification.

Investment objective

The fund aims to provide sustainably compounding performance from global equity markets over the economic cycle on a total return over a long-term investment horizon.

Investment approach

The fund adopts a long-term investment approach, unconstrained by traditional benchmarks, enabling concentrated focus on a selection of up to 25 ‘world class’ mega-caps which, over time, aim to deliver sustainable above average

returns through the strength of their market position in an attractive industry.

Particular focus is given to ‘quality’, compounding stocks which are characterised by their ability to generate sustainably growing excess cash returns over their equity’s cost of capital, part of which is expected to

be returned to shareholders. Other quality characteristics include management and balance sheet features, as well as a relatively predictable earnings profile.

The fund’s focus on high-quality stocks, across a number of attractive industries, balances its high concentration, low turnover approach. The fund maintains minimum levels of diversification and liquidity risk management by adhering

to the UCITS regulated fund framework.

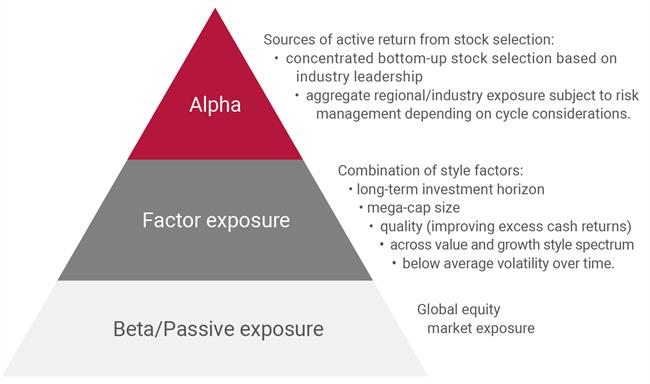

Sources of investment return

Our investment process reflects a long-term focus

Portfolio construction

Long-term investment focus:

- Ideally five years, with a minimum of three years

- Limited turnover (<25% per year on average)

- Unconstrained by benchmark

- Significant tracking error (5-10%)

Focus on attractive industries:

- Sustainable barriers to entry and oligopolistic market structure

- Structural growth, pricing power and/or

- Consolidation opportunities

Regional and industry exposures subject to risk management given economic/industry cycle considerations.

Want to take up this investment opportunity?

*Not all products and services described in this document are available in all jurisdictions and some are available on a limited basis only due to local regulatory and legal requirements. The material contained herein is not intended for use by persons located in or resident in jurisdictions which restrict its distribution. Persons accessing this document are required to inform themselves about and observe any relevant restrictions.

Global Leaders Equity Fund

A concentrated portfolio of the world’s most prominent companies, household names and industry leaders, designed to provide you with peace of mind.

When interest rates from bank accounts and bonds are so low,

having prominent international equities can significantly improve your risk-adjusted returns over the long-term.

These are mega-cap businesses, each worth over US$20 billion, with a global presence and constituents of the major indices such

as the Dow Jones or Nikkei.

| ISIN |

LU0923646821 |

Sedol |

B8DT4F2 |

Bloomberg |

AISGLRU LX |

| Currency |

US dollar |

Risk rating |

High |

Domicile |

International - Luxembourg |

| Launch date |

02/09/2013 |

Fund size |

144.5500 m |

Dealing |

Daily |

| NAV |

20.5339 |

Daily change |

-0.39% |

Price date |

15/01/2026 |

*Hover on chart to see values

Ashburton Global Leaders ZAR Equity Feeder Fund

A concentrated portfolio of the world’s most prominent companies, household names and industry leaders designed to provide you with peace of mind.

When interest rates from bank accounts and bonds are so low, having prominent

international equities can significantly improve your risk-adjusted returns over the long-term.

These are mega-cap businesses, each worth over US$20 billion, with a global presence and constituents of the major indices such as the Dow

Jones or Nikkei.

Factsheets

Ashburton Global Leaders ZAR Equity Feeder Fund

Speak to your financial advisor or read more and invest directly online.

FSB approval for Global Leaders Equity Fund - 12 March 2014

Mar 12, 2014, 13:58

by

Ashburton Investments

Ashburton Investments, the investment management business of FirstRand Limited (FirstRand), has gained FSB (Financial Services Board) approval for its recently launched Global Leaders Equity Fund for distribution to South African investors.